Florida Investment Property: Where, How, and What to Buy

Thinking of investing in Florida real estate? The Sunshine State remains one of thebest places to buy a rental property in 2026. In this guide,...

5 min read

Rent To Retirement : Feb 17, 2026 6:19:36 AM

Want to buy a piece of the Texas housing market? For years, investors have flocked to the Lone Star State to buy rental properties and grow their portfolios. In this article, you’ll learn why this is such an attractive place to invest, how to buy your own Texas investment property, and why turnkey rentals make it easy for anyone to invest remotely!

Summary:

Browse turnkey Texas investment properties with tenants in place!

What makes buying a Texas real estate investment such a good move? Texas stands out as one of the best states to invest in real estate in 2026 and beyond, due to a variety of factors:

Texas is currently the second-fastest-growing state in the U.S. This trend could continue, as Texas’s population is estimated to grow by 11.4% from 2020-2030.

Despite large multifamily rents softening in many Texas markets and across the U.S., Texas A&M predicts single-family rental rates to increase. This means you could charge more for a normal home or turnkey rental property.

Everything is bigger in Texas, including its real estate markets! San Antonio, Houston, Dallas, and Austin are all large metropolitan areas in their own right and great areas to own rental properties.

Housing affordability is still an issue nationwide, but builders are giving substantial discounts on new build inventory in Texas. Rent to Retirement has partnered with builders to get investors exclusive incentives like interest rate buydowns, rent credits, closing credits, and cash back after closing (up to $50,000!).

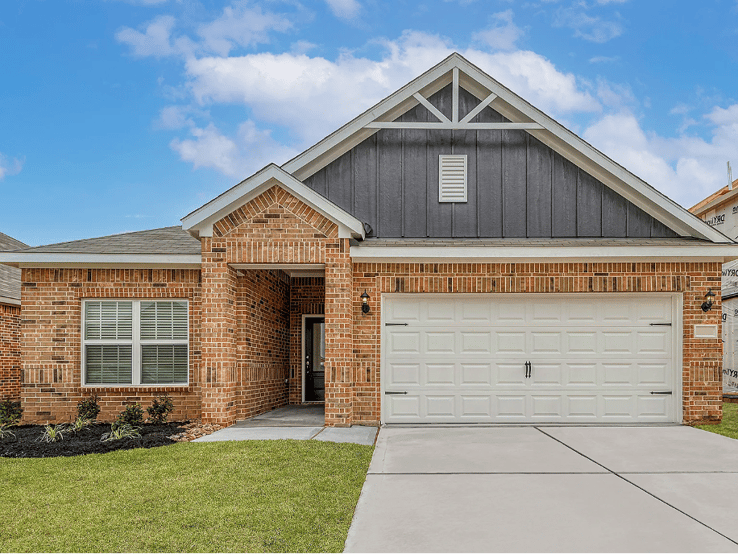

Even when buying in popular areas of Texas, investors can still achieve cash flow, thanks to builder incentives. This property in the Houston metro area has an estimated cash flow of $289 per month!

While Texas has been a powerhouse real estate investing state for decades, its high property taxes are often investors’ biggest concern. Despite being in the top ten states for property taxes, its steadily rising home prices, combined with growing population and strong economic indicators, still make it a win-win for investors who want cash flow and appreciation.

Texas is the nation’s second-largest state, both in terms of size and population. While there are many potential markets to choose from, here are a few of the best areas to target:

Currently the fourth-largest city in the U.S. and still growing, Houston is expected to add over 30,000 new jobs in 2026. Houston home prices are still surprisingly affordable, with an average home price of roughly $260,000 and a respectable average rent of $2,100. Don’t want to own property in the heart of Houston? Smaller sub-markets like Katy are growing fast, too!

Browse cash-flowing turnkey rentals in growing markets like Katy, Texas!

Average home and rent prices as of February 2026.

Houston may be Texas’s largest city, but Dallas-Fort Worth is its largest metro area and the fourth-largest in the country. Often called “the Silicon Prairie,” Dallas-Fort Worth’s economy is largely driven by its strong technology, manufacturing, telecommunications, and energy sectors. At roughly $301,000 and $292,000, respectively, Dallas and Fort Worth’s average home prices sit well below the national average of around $357,000!

Average home and rent prices as of February 2026.

Looking for an affordable yet steadily-growing market to invest in? Of Texas’s four major metros, San Antonio has the lowest average home price at just $245,000. What’s more, its population has grown each year for many decades, with an economy fueled by strong healthcare, education, and military sectors.

Average home and rent prices as of February 2026.

Many investors don’t have time to deal with tenants, maintenance, and evictions, in which case buying turnkey is often the right move. Here are a few reasons why many investors prefer turnkey rentals:

Turnkey rentals often come with property management and tenants already in place. Not only does this save you time, but it also gives you peace of mind that someone is handling your property’s day-to-day from the moment you close.

Turnkey rentals, and specifically, new builds, often come with incentives that can turn your next Texas investment property into a home-run deal. Rent to Retirement’s new build incentives include cash back after closing, lower closing costs, rent credits, free property management, and lower interest rates!

Turnkey rentals are either newly built or recently renovated, meaning they typically require less maintenance than the average property. With fewer dollars going toward repairs each month, you’ll have more cash flow!

It can be difficult to grow your rental portfolio, especially when investing out of state. Each new property usually requires you to hire another property manager and screen new tenants—unless you buy turnkey. With Rent to Retirement, you could have property management and tenants already in place when you take over!

With a newly built or renovated property, you can usually charge higher rents. This could help boost your cash flow and help you attract quality tenants!

Whether it’s turnkey real estate or another type of rental, follow these steps to buy your first investment property in Texas:

First, determine if turnkey rentals are the right fit for your goals and investment strategy. There are dozens of turnkey providers to choose from, but Rent to Retirement holds an A+ rating on the Better Business Bureau (BBB) and is the highest-rated turnkey company on BiggerPockets!

Narrow down your criteria (or your “buy box”), pick your Texas market(s), and start browsing properties in the area. You can also check out our turnkey rental properties for sale, where you’ll be able to see your potential cash flow and return on investment (ROI)!

Next, you’ll need to talk to a lender, determine your purchasing power, and get pre-approved for a mortgage. Rent to Retirement works with investor-friendly lenders to get you the right type of loan at a great rate!

Once you’ve found investment properties you’d like to buy, start submitting offers. With Rent to Retirement, you can choose from several new-build incentives, like lower closing costs, cash back after closing, or a lower interest rate!

You’re under contract, but now you’ve got to do your due diligence and confirm the property’s condition. Get an inspection, purchase landlord insurance, and make sure your lender has everything they need for you to close.

Sign the dotted line and get your property rented out. If you’re buying a turnkey property, it may already come with property management and tenants, in which case you may be able to cash flow right away!

Texas offers affordable, cash-flowing properties, but if you’re investing remotely or want more passive income, consider a turnkey rental property. Rent to Retirement has exclusive incentives with builders, giving you access to rent credits, post-closing credits, free property management, and interest rate buydowns. Buying a low-maintenance, professionally managed, discounted rental property is a great way to either start or scale your portfolio sustainably!

Steady population growth, strong rental demand, and other demographic trends indicate that investing in Texas real estate could pay off for rental property investors in the years ahead. With many markets offering a mix of affordable home prices and solid cash flow, the state is ripe with opportunity for new and experienced investors alike.

Texas is home to several large metropolitan markets, such as Austin, Dallas, and Houston. Where you choose to invest depends on your goals, budget, and familiarity with the market, but with turnkey rentals, you’ll have boots on the ground no matter what!

Texas has a booming economy, landlord-friendly rental laws, affordable home prices, and enough cash flow to offset its high property taxes. While some investors are wary of extreme weather and natural disasters, buying a turnkey rental with built-in property management puts a local expert in your corner to help navigate any issues.

Thinking of investing in Florida real estate? The Sunshine State remains one of thebest places to buy a rental property in 2026. In this guide,...

Looking to buy your first or nextrental property? Coming up with an investment property down payment is one of the biggest hurdles new investors...

What is a buy box in real estate? In this article, you’ll learn all about this crucial tool and how to target the right properties for your investing...